How do you deal with the tension between your go-to-market and product teams as you scale? In this post, I will explore one of the central mechanisms behind that tension. If you can name it, you can (hopefully) tame it. Or, if you're lucky, avoid it.

“Fitness”

Product-market fit (PMF) and GTM fit are well-known concepts:

Product-market fit (PMF) is about making sure you have built a product that meets a relevant market demand. Once you have that, GTM fit kicks in and is about figuring out how to get that product into the hands of the market opportunity rapidly and efficiently. (Blackbird VC)

My friend and coworker Ibrahim Bashir recently posted about something he calls Product-Market Flex. He writes:

At any given moment in time, even if you have PMF, you still need to be working towards a future state where the market has evolved, and your product has kept up.

His post—and his treatment of time—got me thinking. What if we viewed PMF and GTM Fit holistically? What if we viewed flex and fit through the lens of the continuous relationship between revenue growth and the cost of operational complexity?

A fitness curve?

The Pendulum

In B2B SaaS, there's always a team or department currently bearing the brunt of growth.

Product bears the brunt of growth when revenue growth involves increased product complexity.

GTM (go-to-market) bears the brunt of growth when revenue growth requires increasing GTM operational complexity.

A company accrues product debt when the product team bears the brunt of growth. The product team ships quickly, does lower-quality work, and increases the complexity of the product. They de-prioritize optimizing existing features and prioritize going broad.

A company accrues GTM debt when the GTM team bears the brunt of growth. The GTM team handles more operational complexity (e.g., selling motions, support motions, etc.) They de-prioritize sustainability and prioritize near-term execution.

In many orgs, it is a pendulum. Product drives and pushes the debt to GTM. And then, the pendulum swings, and GTM drives and pushes the burden to product. Back and forth—hopefully under control, but sometimes with wild swings, and sometimes in a way that consumes everyone.

Product-GTM fitness is about maintaining balance. Part of that is managing natural tensions. And part of that is resisting the idea of necessary conflict.

Revenue vs. Operational Complexity

The core balancing act is figuring out how to grow (revenue growth) while managing (or at least understanding) the cost of additional operational complexity.

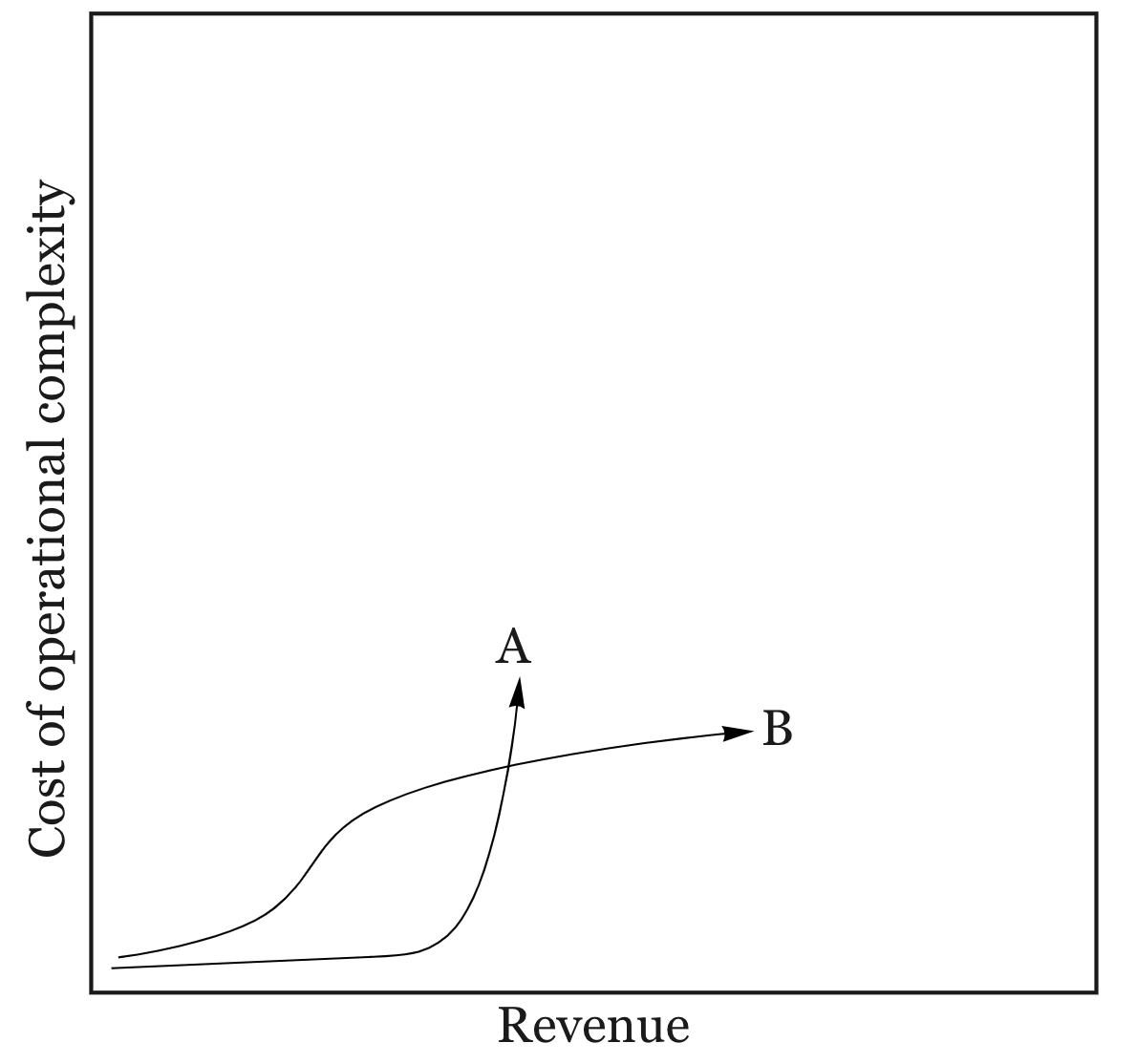

Imagine two companies.

Company A grows rapidly, selling to one segment of customers. Everything is roses until it attempts to sell to a NEW customer segment. The cost of operational complexity rises very sharply. This is when many startups flame out or get acquired.

Company B has some bumps early on. They hit a rough spot. But they adapt, and things level off during their next growth phase.

We can visualize A and B like this:

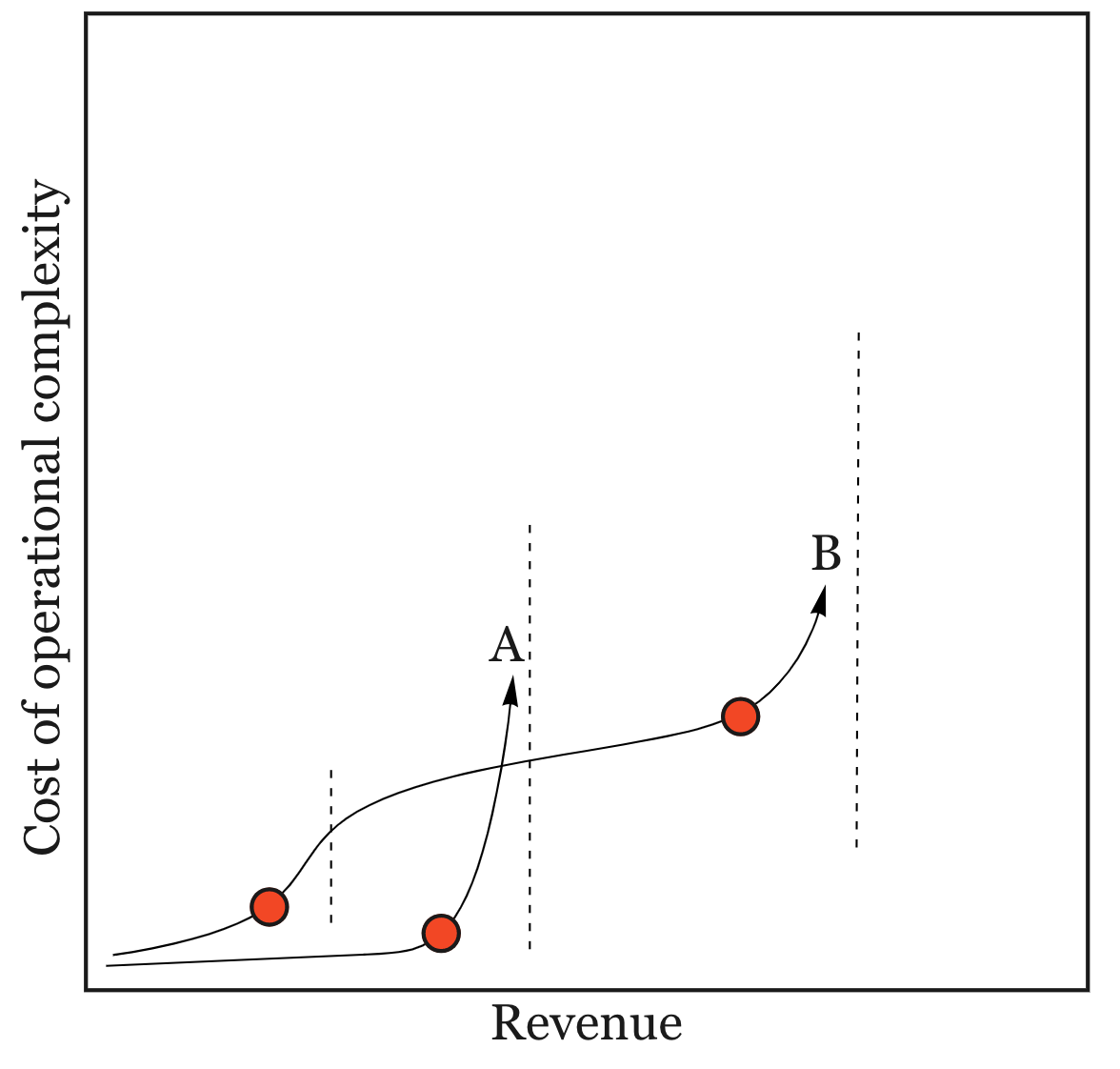

Is B golden? Maybe. Or maybe not. They will likely hit a new "wall" and have to figure it out. Walls are prevalent:

Where it gets VERY tricky is when the company uses the "deal with it" approach, accumulates debt, but doesn't acknowledge the debt:

Why might this perception asymmetry happen?

Teams can absorb a lot of complexity without cracking—especially in the short term. Wishful thinking and the team's capacity for heroics increase the delta between reality and interpretation. Let this gap increase too much, and you run the risk of things collapsing. If macroeconomic conditions change suddenly for the worse, you'll be left in a precarious position because you can't keep paying the interest on operational complexity debt (product or GTM) with a bigger team.

Another reason this might happen is that increases in operational complexity may not be immediately visible. The impacts might not "kick in" until you try to renew and expand customers (or grow a particular customer segment). Meanwhile, revenue is tangible.

“Managing” Increased Complexity

There are four ways to “manage” increased operational complexity.

Offload

Tame

Absorb

Avoid

Manage is in quotes, because the perception that we can manage complexity—at least through traditional management approaches—is tenuous.

Offload

Product might opt to build a platform that pushes some of the complexity externally for unique use cases. GTM (and product) might choose to expand their partner network and integration ecosystem. Both attempt to shift operational complexity elsewhere (and can be highly effective or flop).

Tame

Become more operationally savvy and efficient. Tactics here include:

Building the ability to adapt the org chart more fluidly.

Learning and onboarding.

Figuring out how to run lots of contextually appropriate playbooks.

Hiring operational wizards who appreciate systems thinking. They figure out how to handle complexity without overwhelming people.

Some organizations are much better at this than others. But, it is tough to build this muscle without a culture of continuous improvement. GTM debt (or product debt) makes this doubly hard. Finally, there's a non-theoretical limit to this approach. At a certain point, no tricks can tame the beast. The cost of purchasing the capacity for more operational complexity is too high.

Deal/Absorb

Deal with it, accumulate the debt, and hopefully pay it off later. In some cases, this is not a choice—there’s a spike in complexity, and the existing team (and processes) have to absorb the challenge. In other situations, the dynamic is more chronic than acute. Debt slowly accumulates; burnout and attrition increase. “If we just had a better process and new managers with more experience we could TAME (see above) this!” The team habituates to perpetual anxiety and being stretched thin.

Avoid

When we offload complexity, we don’t get rid of it; we shift it. A company may be able to avoid increasing operational complexity altogether:

There's the scary focus option. Has the company truly exhausted all attempts to earn revenue without increasing operational complexity? New markets are exciting, but sometimes (often) companies get distracted by new markets at the expense of their core.

And the thread-the-needle option (the dream option for every single leader). They look to find the magic feature, segmentation approach, or angle that allows them to 1) avoid narrowing scope (see "scary option") and 2) allow them to grow revenue without increased operational complexity. A dream come true!

You can offload, tame, absorb/deal, avoid by focusing, and avoid by threading the needle—all viable tactics. In most organizations, there's a little of everything.

None of these approaches is a sure thing. Offloaded complexity might swing back to becoming an internal concern. Seeking “operational efficiency” (Tame) could sap the life out of creative efforts and end up imposing a mono-process. Absorb risks causing burnout—the debt multiples, with interest. Avoid biases us to chase silver bullets (thread-the-needle).

The good news is that you CAN make progress. Consider a company that establishes a healthy product-led growth (PLG) function. When approached thoughtfully, PLG does some offloading, taming, and avoiding (through focus). Consider another company that approaches continuous improvement holistically, with a systems thinking lens. They “sense” changes quickly, and respond in healthy ways.

With intentionality—and being honest with yourself—progress is possible!

Threading the Needle

Being honest with yourself is hard when there’s a lot on the line.

Let's return to avoid. I presented two avoid options: focus and thread-the-needle. Viewed alongside Tame and Offload, they might look like this:

When we attempt to thread the needle, we try to find some broad feature-set, message, or GTM process that keeps everyone happy—with minimal/no increase in operational complexity. This approach is possible in some pure horizontal products (and pure vertical products).

But…

A danger of "threading the needle" is that we start to believe there is only one segment when there are many segments! What if that reality changes over time? What if the differences become accentuated or impact future growth? Then your only options will be to deal, tame, or offload (or focus and leave some customers unhappy).

When we let our tactics cloud our view of reality, bad things can happen.

It Explains So Much!

So why is this all important for product managers?

At any given time, your company will be balancing growth demands and the cost to temper increasing operational complexity. Depending on the situation, different teams bear the current burden. Your GTM counterparts may be feeling the pain. You may be feeling the pain.

This core tension underpins so many of the pressures we face in product.

Pressure to go broad; when you want to go narrow

Pressure to thread the needle (figure out the "perfect" feature set or approach)

Pressure to accrue debt based on the promise of a future outcome

Pressure to solidify the "ambitious roadmap."

Pressure to build features to close deals

Pressure to offer additional products

Pressure for heroics to deal with new, emerging patterns

Pressure to oversimplify segmentation (because we wish it were simpler)

Pressure to refocus on the core

Pressure for a "platform strategy" or "integrations!"

A great example is the pressure to solidify a roadmap prematurely. Why does this happen? Two potential reasons:

If there's pressure to thread the needle, people want to see the roadmap that will theoretically make all customer segments happy. "Is that possible? What will you build?"

As operational complexity increases, there's demand from everyone to explain what "their" customers will get. "OK, so are you going to consider this segment?"

Many of the power dynamics you face as a product leader result from this tension.

When GTM leaders experience the pressure of increased operational complexity, they push back for product(s) that are easier to sell. When product leaders feel that pressure, they push back on GTM to tame operational complexity and solidify a GTM strategy ("the product is great, you're just not putting it in the right hands").

And founders desperately want a story that scales. So they push for operational rigor (there must be a way to tame this) and thread the needle—the simpler and more cost-efficient (the story), the better. The last thing they want to hear is that things are too hard or will not scale. To their benefit, this is probably why they start startups in the first place.

I met with a product leader from a rapidly scaling company recently. She explained how this core tension had impacted her. Paraphrasing:

It never really occurred to me how important this tension is! I used to have a very purist view of product. A great product strategy and being focused on customers were all you needed.

But my time in startups has taught me that the tension between the growth story and reality explains like 80% of all the weirdness. It explains why the board meeting ends, and suddenly there are a million questions. It explains why a single investor with one market view can have so much influence. It explains the rotating door of leaders in certain departments. It explains why there is a push for simplicity on one side of the house, and then a push to explain all the gory details on the other side of the house. It explains the tyranny of annual planning—which in many ways is a negotiation over this balance.

Yes, a great product is important. A great product can take you pretty far. But a great product can’t magically solve the problem of how to keep operational complexity under control.

The Stakes are High

This dynamic is incredibly important because one of the core tenants of SaaS is that you are building one product for everyone! Very cost effective!

But what if your operational cost structure changes as you attempt to grow revenue? Differences matter. The range here is vast between companies offering multiple products at almost no incremental extra operational complexity and those where costs (the cost of operational complexity) shoot up exponentially.

This critical point explains why the topic of scaling is so contentious. Everyone wants an easy-to-scale business—investors and founders especially. There's a lot of pressure to imagine your company as a scaling machine. Whether your business is, or isn't, is another question. There's a lot of pressure to imagine that operational efficiencies abound. Whether those operational efficiencies and taming/offloading options exist or not is another question.

Lessons

Don’t decouple product strategy from GTM strategy.

A key lesson for product is that you can't wish away GTM complexity. In particular, you shouldn't develop a product strategy that ignores GTM complexity. While your product personas may be clear, you can't overlook the marketing audiences, buying motion, adoption motion, etc. Those people may not use your product but are critical for success. You might as well get involved in creating customer profiles that can be leveraged by GTM and product and address this head-on. All too often, these efforts are made in silos.

I’d argue that the PLG trend (among others) is, at the core, about using design, data, and technology to bridge these worlds. Most companies fixate on a free trial. Surprise…the free trial “works”, but it just pushed complexity around. Savvy companies think about removing friction for the benefit of customers AND the business, and close the loop on these assumptions.

Look for the signals that fitness is flagging.

A key feature in all this is that it can be hard to figure out what is happening—especially since we don’t want it to happen! Every bone in our body wants an easily tame-able, offload-able, or avoidable problem.

Some signals:

Attrition and burnout. Apathy and “checking out”.

Strategy discussion seem to go in circles. “What’s your strategy?” “Here it is!” “Wait, what’s your strategy?” The undercurrent here is that people are looking for a thread-the-needle approach.

Any kind of circular, elephant-in-the-room narrative. At the core, the tension is about the push for growth vs. a concurrent grappling with increased operational complexity.

Calls for “operational rigor” without a concurrent acknowledgment that focus is required. The subtext is: do more with less.

Lack of real understanding about what is working.

Performative efforts on the part of product to show they have a plan.

Reactive u-turns after board meetings.

Early signals that you’re getting dragged down by debt (product, GTM, or otherwise).

Any “justing”. If we could just execute. If we could just get this release out. If we could just…. Why? This indicates thread-the-needle thinking.

Simple models continuously break down. There’s a difference here between simple models that do their job, and then must be gracefully retired—and models that never get off the ground.

You need to stay on top of these signals. You can’t get by with an annual engagement survey.

Be explicit and transparent about your tactics and assumptions.

Finally, it might help to be explicit about your current approach to managing increasing operational complexity. Is your current strategy to:

Offload

Tame

Deal/Absorb

Avoid

Thread-the-needle

Focus

If it is to avoid, is your approach to thread the needle (figure out the magic thread that links all segments) or focus? What are your assumptions? What will progress look like? What are the warning signals of decline? Both product and GTM teams can be much better about this. How often has your team’s implicit strategy been Deal, while the public narrative is Focus?

When attempting to thread-the-needle, make sure to leave a path back to reality. Don’t let your tactics cloud your assumptions.

Start there. Create some shared understanding with your team. Talk about these things openly, instead of in shrouded terms.

Conclusion

I’ve hit my time-box for this post.

Was this type of post interesting? Boring? Should I continue this thought?

Great article that describes the complex dance of B2B(2C) product strategy. More like this please!

Interesting! I’d love to see future posts exploring “Tame, Offload, Deal with, and Avoid” on real situations you’re hearing about. Great framing!