I encourage teams to think about their roadmap as a portfolio of bets. Different initiatives have different risk/reward profiles. When the strategy and goals change, the mix changes. You can hedge and over-hedge.

People often describe startups as risky. But depending on the startup, that risk profile might vary. Some startups aren't amenable to experimentation yet tackle huge opportunities. Other startups tackle more modest opportunities, with more leeway for experimentation.

Early on you don't have much of a bet portfolio. It is what it is. But as you grow, you end up diversifying. The big question is whether you "balance" your portfolio. Or let the competition do it for you.

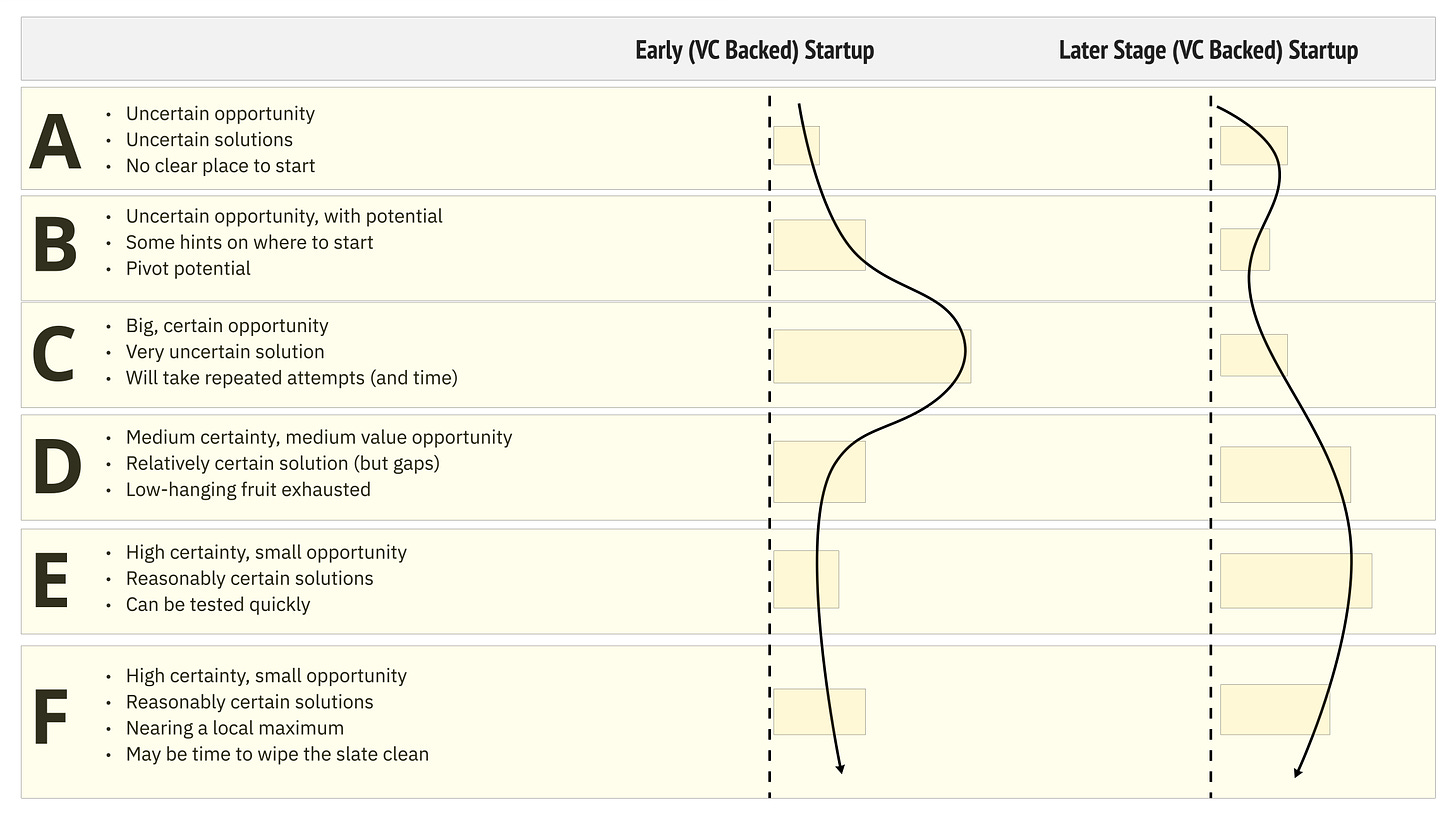

Here's a helpful way to think about your bet portfolio. Imagine these six categories of bets. This is quick take—don't take these categories too seriously. Now picture an earlier stage VC-backed startup compared to a later stage company.

You can see the "balance" shift. At a high level, we are accounting for:

Certainty around the opportunity

Certainty around the solution

Amenability to experimentation

With each level, we tweak these variables slightly. Why is this a helpful idea?

Lots of companies have no words for any of this. They throw around the word "innovation", but nothing ever fails (hint: not innovation). They talk about "zero to one" and "big swings" without any real context. They ignore opportunities in their existing product in the quest for shiny new things. They talk about value vs. effort, without any distinction between opportunity risk and solution risk. They run diverse motions as a company, and magically expect a mono-process to reign it all in.

They lack intentionality.

That's all for this week. Think about how to balance your portfolio of bets as a team. Try to converge on a model that works for you, and visualize how your current bets fit the model.

I like this approach. Will have to step back and think about the shape of the bet(s) my company is looking at through this lens. Thanks.